Nvidia earnings beat expectations despite US export controls

Nvidia on Wednesday reported earnings that topped market expectations, with a $4.5 billion hit from US export controls being less than the Silicon Valley chip juggernaut had feared.

Nvidia said it made a profit of $18.8 billion on revenue of $44.1 billion, causing shares to rise nearly four percent in after-market trades.

Nvidia in April notified regulators that it expected a $5.5 billion hit in the quarter due to a new US licensing requirement on the primary chip it can legally sell in China.

US officials had told Nvidia it must obtain licenses to export its H20 chips to China because of concerns they may be used in supercomputers there, the Silicon Valley company said in a Securities and Exchange Commission filing.

The new licensing rule applies to Nvidia GPUs with bandwidth similar to that of the H20.

The United States had already restricted exports to China of Nvidia's most sophisticated GPUs, tailored for powering top-end artificial intelligence models.

Nvidia was told the licensing requirement on H20 chips would last indefinitely, it said in the filing.

The new requirements resulted in Nvidia incurring a charge of $4.5 billion in the quarter, associated with H20 excess inventory and purchase obligations "as demand for H20 diminished," the chip-maker said in an earnings report.

US export constraints stopped Nvidia from bringing in an additional $2.5 billion worth of H20 revenue in the quarter, according to the company.

Nvidia chief executive Jensen Huang said demand for the company's technology for powering AI remains strong, and a new Blackwell NVL72 AI supercomputer referred to as a "thinking machine" is in full-scale production,

"Countries around the world are recognizing AI as essential infrastructure -- just like electricity and the internet -- and NVIDIA stands at the center of this profound transformation," Huang said.

- Hot demand -

Nvidia high-end GPUs (graphics processing units) are in hot demand from tech giants building data centers to power artificial intelligence.

Nvidia said its data center division revenue in the quarter was $39.1 billion, up 10 percent from the same period a year earlier.

The market had expected more from the unit, however.

"Nvidia beat expectations again but in a market where maintaining this dominance is becoming more challenging," said Emarketer analyst Jacob Bourne.

"The China export restrictions underscore the immediate pressure from geopolitical headwinds but Nvidia also faces mounting competitive pressure as rivals like AMD gain ground on cost-effectiveness metrics for certain AI workloads," said Emarketer analyst Jacob Bourne.

Revenue in Nvidia's gaming chip business hit a record high of $3.8 billion, leaping 48 percent in a year-over-year comparison and eclipsing forecasts.

The AI boom has propelled Nvidia's stock price, which has regained much of the ground lost in a steep sell-off in January triggered by the sudden success of DeepSeek.

China's DeepSeek unveiled its R1 chatbot, which it claims can match the capacity of top US AI products for a fraction of their costs.

"The broader concern is that trade tensions and potential tariff impacts on data center expansion could create headwinds for AI chip demand in upcoming quarters," analyst Bourne said of Nvidia.

"This doesn't signal an end to Nvidia's dominance, but highlights that sustaining it will require navigating an increasingly complex landscape of geopolitical, competitive, and economic challenges."

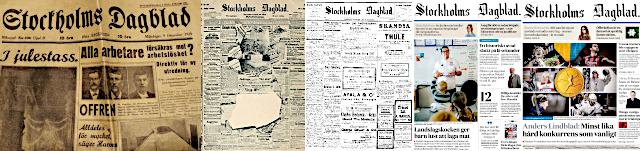

V.Ekstrom--StDgbl