Asian, European markets rally ahead of US jobs data

Asian and European markets advanced on Friday, in line with a global equity rally ahead of a US jobs report that will give insight about the Federal Reserve's next move on interest rates.

A frenzied selloff of Chinese stocks meanwhile slowed over reports of a regulatory clampdown.

The global bond market also eased after yields had jumped this week on concerns over mounting government debt.

London, Paris and Frankfurt were having a fair time of it, trading up at the open on Friday.

Across the pond, investors will be looking to US government jobs data due on Friday to cement rate-cut bets.

"All eyes will be on Friday's nonfarm payrolls report with bad news likely to be interpreted as good news as it will raise the market probability that the Fed cuts rates," said Victoria Scholar, head of investment at Interactive Investor.

Weekly data released on Thursday showed more first-time claims for unemployment benefits in the United States than analysts had expected, while figures from payroll firm ADP showed slowing private sector hiring in August.

"Investors now look for final confirmation that the weakening trend is entrenched and justifies a Fed cut –- or two," said Ipek Ozkardeskaya of Swissquote bank.

In Asia, an August rally in Chinese stocks, fuelled by surging shares in semiconductor firms, ground to a halt this week, with Cambricon Technologies crashing 14 percent on Thursday, as investors weighed potential regulations.

China's blue-chip CSI 300 benchmark was recovering on Friday after falling 2.1 percent the previous day -- the largest drop since early April, when US President Donald Trump's tariff threats caused the index to drop more than seven percent in one day.

Tokyo and Hong Kong were both up on Friday and Shanghai's benchmark index, which was tracking down in early trading, had clawed back up.

Analysts said earlier falls had followed a Bloomberg report that China's financial regulators might implement measures to cool the pace of the selloff in stocks.

"The selloff is more than a blip; it's the first crack in the facade of a $1.2 trillion melt-up that had traders whispering about deja-vu and a speculative frenzy reminiscent of the 2015 'crazy bull'," said Stephen Innes of SPI Asset Management.

Japanese long-term government debt yields also eased on Friday, while the Nikkei failed to extend early-session gains.

Gold remained a refuge for investors, who have been turning away from long-term bonds once considered safe assets.

Bullion consolidated near its all-time high, while oil prices extended losses on Friday in anticipation of excess supply in the coming months, as OPEC+ nations are expected to further unwind production cuts.

"Geopolitical risks... remain elevated, with mounting fears of further Russian attacks on Ukraine. That keeps downside potential in oil limited, likely into the $60–62 range," Swissquote's Ozkardeskaya said.

Oil has tumbled 12 percent this year as global producers outside OPEC+ ramp up and tariffs curb demand.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 1.0 percent at 43,018.75

Hong Kong - Hang Seng Index: UP 1.54 percent at 25,445.60

Shanghai - Composite: UP 1.24 percent at 3,812.51

London - FTSE 100: UP 0.3 percent at 9,240.84

Paris - CAC 40: UP 0.3 percent at 7,723.97

Frankfurt - DAX: UP 0.7 percent at 23843.24

Euro/dollar: UP at $1.1673 from $1.1649 on Thursday

Pound/dollar: UP at $1.3455 from $1.3437

Dollar/yen: DOWN at 148.24 yen from 148.45 yen

Euro/pound: UP at 86.75 pence from 86.72 pence

West Texas Intermediate: DOWN 0.5 percent at $63.15 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $66.72 per barrel

New York - Dow: UP 0.8 percent at 45,621.29 (close)

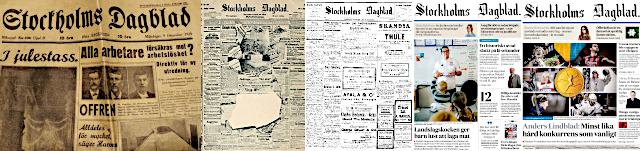

E.Henriksson--StDgbl