US Senate panel advances nomination of Trump's Fed governor pick

A US Senate committee on Wednesday advanced the nomination of President Donald Trump's choice to join the Federal Reserve board, despite concerns that he might not resign from the White House even if confirmed.

Stephen Miran, who chairs the White House Council of Economic Advisers (CEA), passed the Senate Banking Committee's vote by 13-11, with Democratic lawmakers opposing the advancement.

Nonetheless, this vote clears the path for his full Senate confirmation, meaning that he could be in place on the central bank's rate-setting Federal Open Market Committee (FOMC) by its next meeting on September 16-17.

Senator Elizabeth Warren, the top Democrat on the banking committee, warned that Miran's nomination "sets up an obvious Trump loyalty test."

Trump has ramped up pressure on the independent Fed to slash interest rates in recent months, and Warren argued that Miran's votes on rate decisions could determine if he is able to return to his White House job after his stint at the bank.

If confirmed, Miran fills a short-term Fed vacancy for slightly over four months until January 2026.

Due to the short stint, Miran told the Senate Banking Committee last week that he only planned to take a leave of absence from the CEA if confirmed to the bank.

But upon further questioning by lawmakers, he said that he would step down if nominated and confirmed for a longer Fed term.

After his hearing, Democratic lawmakers issued a letter to Miran arguing that his actions as a Fed governor would be questioned as a move "to satisfy the demands of the President" and retain his White House position.

Warren also expressed fears that he has not committed to resigning from the Fed at the end of his abbreviated term if confirmed.

The seven members of the Fed's powerful board of governors are among the 12 voting members of the central bank's rate-setting FOMC.

Since its last interest rate cut in December, the Fed has held rates steady this year as officials monitored the effects of Trump's sweeping tariffs on inflation.

Analysts widely expect the Fed to cut rates next week, however, given that the tariffs appear to be having a limited impact on inflation for now while the jobs market is weakening.

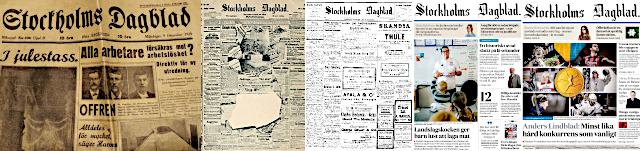

G.Lindholm--StDgbl