New tech and AI set to take athlete data business to next level

From tracking the trajectory and speed of a footballer's strike to monitoring a Tour de France rider's real-time power output, performance athlete data is deepening its reach in sports, with specialised firms eyeing to score big business.

The potential is huge, analysts say, not just for helping coaches further refine training and game-day strategies, but for providing novel content to broadcasters or enticing fans to online betting markets.

Sports data analysis has surged since the days of "Moneyball", the hit 2011 film with Brad Pitt that recounts manager Billy Beane's groundbreaking exploitation of player statistics at the Oakland Athletics baseball team.

Wearable performance sensors, new camera technologies and the power of artificial intelligence are drawing in companies looking to exploit the possibilities.

"When a professional club or federation has data on their players, we can analyse it and make recommendations on how to optimise their performance or avoid an injury," said Frank Imbach, a director of the French group SeeSports.

Some firms use the cameras in stadiums and arenas to track individual players at all times, whether they have the ball or not.

Others rely on body sensors that can determine speed, breathing rates or cardiovascular readings.

"This very reliable data lets you recreate 100 percent of what is happening on the field, without just following the ball around," said Arnaud Santin, co-founder of the Britain-based start-up SportsDynamics.

- Off-season potential -

This holistic approach, which SportsDynamics offers as a Silicon Valley-inspired software as a service (SaaS) model, potentially lets clients analyse not only their own players, but those of any opponents.

"For big games, we can be providing 50 images per second," Santin said. "The technology development allows us to accelerate very quickly."

Several industry experts are anticipating exponential growth as European and Asian markets catch up quick with US adopters.

"Reports forecast that the European sports analytics market will swell to multibillion-dollar size over the coming decade," said Lodovico Mangiavacchi of the global consulting firm EY.

"One study from Market Research Future predicts it will reach $7.5 billion by 2032," he said.

"Behind these numbers lie investments in wearables, sophisticated video analysis tools, and Internet of Things devices," he added.

The Germany-based Data Sports Group uses live TV coverage of sports including rugby and cricket to provide content to media clients but also gaming and fantasy sports providers.

For bookmakers, DSG is "giving their bettors some tools, like statistics and reference material over a period of archives, so they can take decisions on that", said Rajesh D'Souza, its business director.

Game and player data can also be used to create content like fantasy league face-offs that will keep fans coming back even in the off seasons, when there are no big games.

- Valuable numbers -

The surge in amounts of valuable data raises questions about who has control of it, as well as the need for investments to protect the data from theft.

In Europe, such personal data requires compliance with the EU's General Data Protection Regulation (GDPR) on user privacy.

But in any case, "professional athletes, in the majority of cases, sign a contract that allows their clubs and the league to use their data", said Santin of SportsDynamics.

In a sign of expectations of enthusiastic demand, sports data deals have been getting bigger.

In February, Genius Sports, an American data and technology specialist, announced a deal to buy the betting and gaming content platform Legend for $1.2 billion.

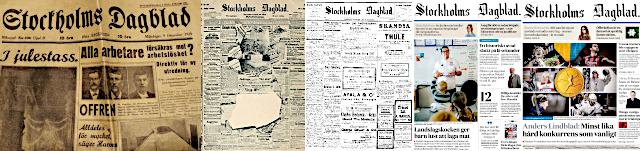

L.Sundstrom--StDgbl